[ad_1]

Kosamtu | E+ | Getty Images

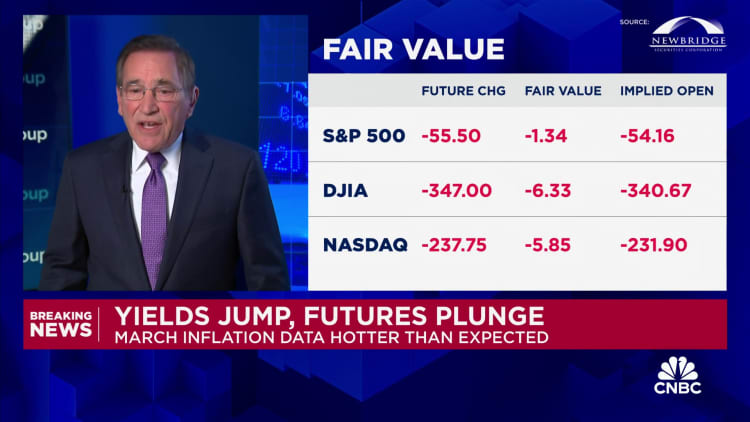

Investors are jittery following a hotter-than-expected batch of inflation data on Wednesday, suggesting the fight to rein in consumer prices may take longer than expected.

But there are categories of goods and services that have deflated — that is, their prices have actually dropped.

Consumers have primarily seen prices falling for physical goods, such as cars, furniture and appliances, though they’ve also declined for some food and energy-related products, too.

“You’re still seeing some pockets of deflation,” said Sarah House, senior economist at Wells Fargo Economics.

That downward pressure has tamed in recent months, though, as some supply-and-demand dynamics that were thrown out of whack by the Covid pandemic have normalized, House said.

Deflation is “not quite the monolith it was maybe last year,” she said.

The home goods craze is over

Demand for those goods soared early in the pandemic era as consumers were confined to their homes and couldn’t spend on things like travel or concerts.

The health crisis also snarled global supply chains, meaning volume couldn’t keep pace with demand for those goods.

Such supply-and-demand dynamics drove up prices. Now, though, they are falling back to earth.

Prices for household furnishings have fallen consistently for about a year, for example, House said.

In addition, laundry equipment prices are down 14.6% from the year-earlier period, according to the consumer price index for the month of March. Among all household appliances, prices are also down 6.3% during that period.

Meanwhile, prices have fallen for furniture and bedding (down 3.8%), dishes and flatware (-3.9%), toys (-8.2%), outdoor equipment and supplies (-4.9%) and sporting goods (-2.2%).

The initial pandemic-era craze for consumers to fix up their homes and upgrade their home offices has diminished, cooling prices.

“There are only so many throw pillows that you need,” House said.

The U.S. dollar has also been historically strong relative to other global currencies, a dynamic that helps rein in prices for goods, economists said. This makes it less expensive for U.S. companies to import goods from overseas, since the dollar can buy more.

The Nominal Broad U.S. Dollar Index is higher than at any pre-pandemic point dating to at least 2006, according to Federal Reserve data. The index gauges the dollar’s appreciation relative to currencies of the nation’s main trading partners such as the euro, the Canadian dollar and the Japanese yen.

Why deflation is happening elsewhere

Prices for new and used vehicles have also deflated slightly over the past year, by 0.1% and 2.2%, respectively. They were among the first categories to surge when the economy reopened broadly early in 2021, amid a shortage of semiconductor chips essential for manufacturing.

Meanwhile, travel costs for airfare, hotels and rental cars have also declined by a respective 7.1%, 2.4% and 8.8% since March 2023.

More from Personal Finance:

Here’s the inflation breakdown for March 2024 — in one chart

Why the Fed is in no rush to cut interest rates in 2024

Here’s how to determine how inflation affects you

Airlines have increased the volume of available seats for travelers by flying larger planes on domestic routes, which has helped push down prices, for example, according to Hayley Berg, lead economist at travel site Hopper.

The price of jet fuel, a key input cost for airlines, is also down relative to last year, Berg said. Fuel oil is down 3.7% annually, according to CPI data, though rising oil prices have lifted those of other energy commodities like gasoline in recent months.

Broadly, grocery prices “have come to a standstill,” said Mark Zandi, chief economist at Moody’s Analytics.

Some food categories like ham, cheese and coffee have declined. Notably, consumers have seen apple prices fall 10.1% in the past year amid burgeoning supply.

Elsewhere, some deflationary dynamics may happen only on paper.

For example, in the CPI data, the Bureau of Labor Statistics controls for quality improvements over time. Electronics such as televisions, cellphones and computers continually get better, meaning consumers generally get more for the same amount of money.

That shows up as a price decline in the CPI data.

[ad_2]